|

[Shortened Settlement Cycle on US market] As per announcement from the U.S. Securities and Exchange Commission, the settlement cycle will change to T+1 (current T+2) starting from trade date on 28 May. More>> |

|

|

[Birthday of the Buddha] [HK Market] will close on 15 May(Wed)[Northbound Trading] will close on 15 May(Wed) |

|

|

[US Sec Fee adjustment] In response to the U.S. Securities and Exchange Commission's notice of adjustments to transaction fees ("SEC Fees"), 2024, this new rate will take effect for transaction on Wednesday, May 22, from 0.0008% to 0.00278% for seller only.More... |

|

FAQs

FAQs

|

Account Opening

-

Q1What choices do I have in terms of account type? >A1You can open a cash trading account under your individual name (Individual Account), jointly with another individual (Joint Account) or on behalf of your company (Corporate Account).

-

Q2Is there a minimum cash deposit requirement to open an account? >A2No

-

Q3How do I go about opening an account? >A3Please get in touch with us to open an account. You can access our contact details by clicking on the "Account Opening" button (in red) at our homepage. Please post to us or come to our office in person during office hours, and provide the followings for verification purpose:

-

your identity card;

-

a proof of your residential address in the past three months, eg, an utility bill with your name and address; and

-

a proof of your finances.

-

-

Q4Is there any fee to open an account? >A4No, it is free of charge to open an account.

-

Q5How long does it take to open an account? >A5The account opening process is simple. If you visit our office with all required materials, we can process the paperwork for you right there. If you choose to open an account by post and attach all required materials in a notarized format, your account can be set up in two to three business days. You can start trading once you deposit funds into the account.

-

Q6How do I obtain the login information? >A6Once you open an account, we shall send you an email to setup the login password. We encourage you to change your password from time to time as a security measure.

-

Q7What happens if I forget my password? >A7Simply access web or apps login page and click forget password. You will receive an email to reset your login password or call our Client Service hot line (+852-2122-8800) for assistance.

-

Q8Does ASL obligate to submit relevant client information in compliance to FATCA and CRS rules and regulations? >A8Yes

Stock Trading

-

Q1Can I place an online order anytime? >A1Yes, you can. Your order will be accepted even after the market is closed. It will be executed on the next trading day.

-

Q2Can I trade in overseas stocks even though I only have HK dollars? >A2Yes, you can. As long as you have sufficient HK dollars in your trading account with our company, you can use our foreign exchange service to obtain the currency for your overseas stock trades.

-

Q3Under what circumstances would my buy or sell order be rejected? >A3If you do not have sufficient funds in your trading account, your buy order will be turned down. By the same token, if your sell order indicates that you wish to sell more shares than you hold, it will be rejected.

-

Q4How do I look up my account statement? >A4You can view your account balance by logging into your online trading account and clicking into "Account Balance." You can also download a PDF file to print out a statement.

-

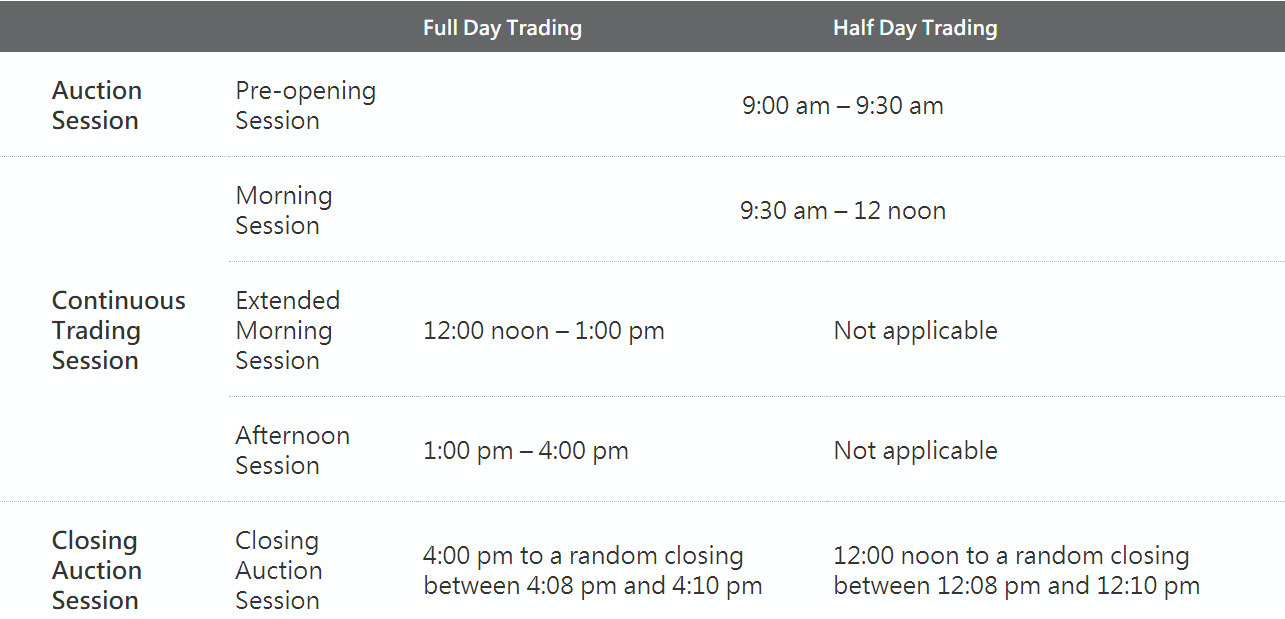

Q5What is a "closing auction session?" >A5From July 25, 2016, the Stock Exchange of Hong Kong Limited added a closing auction session of 8 - 10 minutes to allow investors, notably index-tracking fund managers, to buy or sell stocks at the closing prices. Only certain stocks are eligible for trading during this short interval. Upon receiving orders from buyers and sellers, the trading system will analyse them to select a price that can complete the largest number of buy or sell orders. That is the closing price for that particular stock. Subsequently, buy and sell orders will be queued up according to price and the time they are received, then executed using that single closing price.

-

Q6What is a "board lot?" >A6A board lot is a measurement of buy or sell orders in the Hong Kong stock market. Determined by the issuers of the shares, the number of shares in each board lot may differ from one stock to another.

-

Q7What is T+2? >A7T+2 stands for transaction day plus two days. It refers to HKEx's Central Clearing and Settlement System transferring the shares and settling the payment two days after the transaction day.

-

Q8How do I withdraw shares or transfer shares? >A8Simple download the "Shares Deposit and Withdrawal" form from our online trading website, complete and sign the form then send it by mail to our office address or fax it to (852) 2122-8009. You can also call our Client Service at (852) 2122-8800 for assistance.

When completing the form, please be sure to include the pertinent information of both parties, including broker's company name, contact person and contact number, stock code.

For Anuenue Securities, please note the following details:Company Participant ID Contact Person Contact Phone No. Anuenue Securities Limited B01677 Settlement Department (852)2122-8086 -

Q9How do I deposit physical stock certificates? >A9We handle only physical certificates for Hong Kong stocks. Please visit our office during office hours to bring in your share certificates. We will keep the physical copies for free but charge HK$5 for each letter of transfer.

-

Q10How do I subscribe to shares of an initial public offering ? >A10As our client, you can apply for upcoming shares of a Hong Kong listing candidate (ie, IPO shares) either online using this e-trading site or contact our client service for assistance at (852) 2122-8800. When submitting your IPO application, please make sure that you have sufficient funds in your trading account. We will process your application shortly.

-

Q11Besides Stamp Duty, is there any tax obligation (e.g. Capital Gain Tax) applicable to investors with non-Hong Kong resident status? >A11There is no particular tax obligation applicable to investors with non-Hong Kong resident status. For further fee & charges enquiry, please refer to our webpage: "Fee and Charges"

-

Q12How many types of order instructions and what are the differences? >A12HKEX accepts different order instructions at different time frame, our user friendly trading system has already picked the best order types for you.

Hong Kong trading hour breakdown:

At-auction limit order (AL)

The price that can match most of the trades will be chosen as reference price. The sooner/better price you place the order, the higher chance you can traded.

Order will be placed as a limit order in the market after the pre-opening session if it has not been executed.

Enhanced limit order (EL)

Applicable on continuous trading session. Order will only be executed at a specified price or one better spread (max 10). Your order instruction can be processed at your target price range.

Any remaining quantities of buy/sell order will stay in the queue.

Odd lot

Share trading size which is less than a board lot size is classified as odd lot. Please contact our Securities Trading Hotline 21228800/0080-185-6282 to handle.

Note: Odd lot trades are normally executed at a few spreads below the market.

Trigger order (TO)

Special order type. You can preset the price (that can be supportive / resistance level) (target price 1), and trade price (target price 2) at the same time. Once market price reach target price 1, order with target price 2 will be sent to the market instantly. TO is a great tool to increase the chances of completing the order and reduce market risks in a fluctuated market. However, gapping up/ down of the stocks (or market index) might not successfully trigger the order and TO will not be sending out.

For your convenience, you can place orders that are valid for 7 days.

For further details, please visit HKEX website and the summary of order instructions -

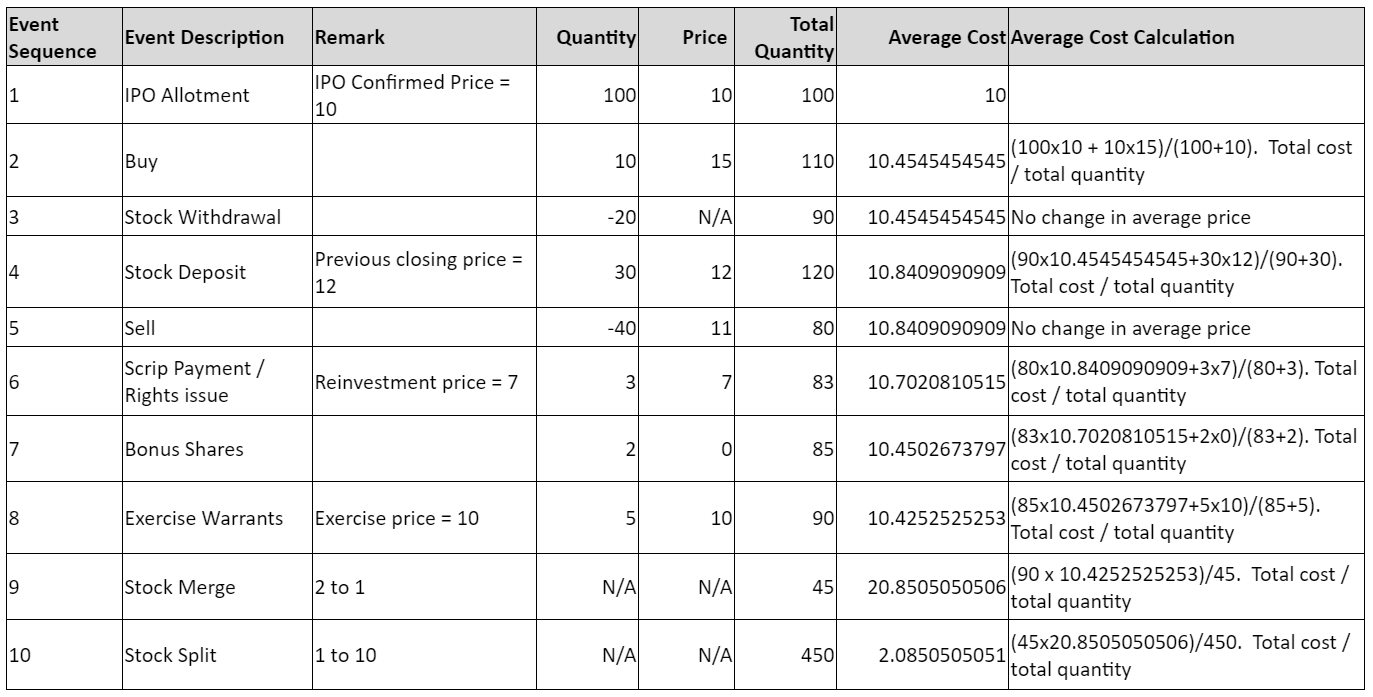

Q13What is "Est. Average Cost" under client's portfolio page? >A13Average cost has been added to client's portfolio page. This cost is automatically calculated by the system. Below is example showing how our average cost is calculated:

Note: Average cost does not include fees, tax and commission.

Example

1) Ms Chan got 100 shares from initial public offering at $10, the average cost was $10

2) The stock price raised to $15 on first trading day, she bought another 10 shares at $15, the average cost became $10.4545 (rounded to 4 decimal places). Average cost was (100shares x 10 + 10shares x 15)/(100+10).

3) Ms Chan withdrew 20 shares. Her total stock quantity was reduced to 90. There was no change in the average cost.

4) Ms Chan deposited 30 shares of the stock. System defaulted the previous day's closing price ($12) as the cost of the deposited shares. (Note that Ms Chan can contact us to adjust this cost if she think the previous day's closing price does not reflect the actual cost)

5) Ms Chan sold 40 shares the stock at $11. There was no change in the average cost.

6) Ms Chan executed the right: 3 shares of stock at $7, the average cost decreased to $10.7021 (rounded to 4 decimal places).

7) Ms Chan received 2 bonus shares and the total shares in system are 85. The average cost decreased to $10.4503 (rounded to 4 decimal places).

8) Ms Chan exercised a warrant, bought 5 shares at $10 , the total shares increased to 90, and the average cost wsa $10.4253 (rounded to 4 decimal places).

9) Stock merged at a ratio 2 to 1, Ms Chan's shares decreased to 45, and the average cost was $20.8505 (rounded to 4 decimal places)

10) Stock split at a ratio 1 to 10, Ms Chan's shares increased to 450, and the average cost was $2.0851 (rounded to 4 decimal places)

** During system upgrade, all holdings' average costs as of 11Nov2016 were set to the latest closing prices available in the system (Please refer to ## below). If clients want to change the average cost, please contact our customer services at 852-2122-8800 or emial to cs@anuenuegroup.com for further assistance.

## Asian stocks, include but not limited to Hong Kong, Taiwan and China 11/11/2016 US market 10/11/2016 Funds / Unit Trusts 30/9/2016 or 31/10/2016, depending on funds

Cash Deposit/Withdrawal

-

Q1What is the exchange rate at ASL? >A1Our exchange rate is based on the rate provided by HSBC.

-

Q2What kind of currency conversion is available at ASL? >A2At ASL, you may convert your cash balance into TWD, RMB, JPY, EUR, USD, AUD, GBP, SGD, and MYR. However, please note that we do not provide wiring transfer service for TWD.

-

Q3Is it possible to wire out money to my same name bank account in any country? >A3Yes, same name bank account in any country.

-

Q4Is the above "Same Name Bank Account" requirement also applicable to deposit money at ASL? >A4Yes, you may choose to deposit money through wire transfer from a same name bank account or issue a Hong Kong Dollar bank cheque bearing client's name.

Others

-

Q1What is "two-factor authentication"? >A1The Securities and Futures Commission of Hong Kong first put this forth on October 27, 2017 as one of 20 rules to enhance safeguards against hacking of online trading. Under the two-factor authentication (2FA) rule, an online trading portal is required to use two of the following factors to "double-check" a client's identity:

-

what a client knows;

-

what a client has; and

-

who a client is.

From April 28, 2018, all online trading logins will have to use 2FA.

To log in under 2FA, a client must use his/her password plus an authentication code generated by Anuenue's Security App. The code is sent by the App to the client's phone and is refreshed at 30-second intervals.

Please refer to this guideline. -

-

Q2How long is the session idle time after logged on?>A2In order to enhance our user experience and trade order placings, the default Session Idle Timeout is set to 1 hour. A Reminder Alert will pop out 10 minutes before timeout. Please avoid accessing your account at public terminals and always remember to logout after use.

© 2024 Anuenue Securities Limited. All Rights Reserved.

|

HKSFC License No. ABW455 / Participant of the SEHK

|

Personal Data Privacy Policy

|

Security Information

|

Disclaimer

HKSFC License No. ABW455 / Participant of the SEHK

© 2024 Anuenue Securities Limited. All Rights Reserved.